By Marc Seltzer; originally published on November 5, 2009, at care2.com

. .

What does a master politician learn from defeat?

Republicans are claiming the November election shows a renunciation of Barack Obama’s nine months of leadership.

Democrats are reassured by the Owens victory in New York: The Conservative candidate was too far to the right for mainstream America.

But President Obama must surely be licking his wounds. He, and his party, should have won the Virginia and New Jersey governors’ races.

Candidate Obama won those states forcefully in November 2008. How could they be lost so decisively now?

Mr. Obama has been in office 9 months. The public saw in candidate Obama a fix for the errors of President Bush: Bad wars would be ended; good wars would be fought successfully; special interests would be put in their place; the super rich would pay their taxes; average Joes would find jobs, and decisions on health care, foreign policy, financial regulation and immigration would solve knotty problems of budget woes, and nuclear fears while making humanitarian advances.

Ruling is far different from campaigning. We are three-hundred million people living under the representational leadership of one head-of-state who shares power with 500 or so others representing each and every bit of our union from the Hawaiian Islands to the Eastern seaboard.

Every President suffers in the elections following their inauguration as the public’s hopes are dashed by the realities of governance. What seemed so obvious and positive in a speech during the campaign becomes so complicated and expensive when you face it squarely and manifest it in policy and law.

But is that it? Is it just disappointment with reality?

I don’t think so. It’s more than that.

The President has presided over one of the most remarkable economic events in U.S. history. The financial industry – a core pillar of American and international business — was brought to the brink of collapse. Democratic and Republican leaders acted quickly and creatively without a playbook to rescue the financial sector. This was not an average recession, but an international crisis of finance that was bigger than the financial system itself. That’s why the government had to step in, but the results will be debated and lessons included in the next generation’s history books.

Possibly fearful of making a mistake, the President has hesitated to explain clearly to the American people just what has happened. Treasury Secretary Timothy Geithner and a league of economists in government and academia have spoken to the causes and reform proposals. With all due respect to Secretary Geithner’s intellect and articulateness, President Obama, with his commanding charisma and office of authority, must lead on this issue.

If the nation had plunged into a depression, rather than skirting perilously around the edge, the President would be expected to lead us through. The fact that we may have avoided more catastrophic losses does not obviate the profound need for leadership to speak powerfully to the causes, remedies, and reform. It is not enough that competent leaders work the process through congressional committees and administrative working groups. The President must face the event squarely and communicate to the public about his presidency’s relationship to these historic times. When I think of the Great Depression, I think of Roosevelt telling the nation “the only thing we have to fear is fear itself.” When I think of the bombing of Britain, there is Churchill saying, “I have nothing to offer but blood, toil, tears, and sweat.” But when I think of the financial crisis of 2008-2009, I think of Paul Krugman and Bloomberg Economics.

And this leads back to November 3, 2009. The reason that the Democrats lost in battles against Republicans is that the public is concerned about direction of the government on the economy. What has the President done in 9 months of office? He has addressed the financial crisis and pushed ahead on health care. Both of these programs deal fundamentally with economics (if money grew on trees, we wouldn’t bother with insurance reform) and the fiscal state of the nation. Yet the President has not yet done what he is capable of to express a coherent financial plan on either issue. He is, of course, subject to Republican criticism no matter what, but more important than that, he does not have the confidence of the moderate middle of the country who decide close elections.

Bill Clinton lost a great deal of his authority in 1994 when the Republicans retook power in Congress two years into his presidency. President Obama has had a hint of what can happen in the losses in Virginia and New Jersey. A gift in disguise?

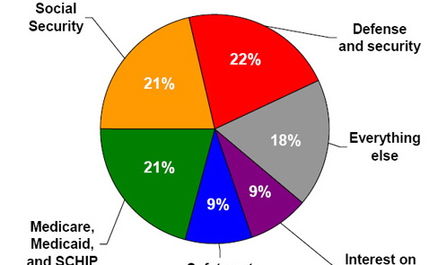

Mr. Obama needs to refocus his communication priorities to explain to the American people his short- and long-term economic vision. He needs to include a convincing dose of reality in his message rather than campaign rehtoric — not just “economic recovery” and “bend the cost curve” but targets for deficit and debt, goals for long term spending and revenue, transition from stimulus to private economic activity. And the President must deliver and stay on the message himself in order to inspire confidence in the majority of Americans.